income tax rate indonesia

Public companies that have a minimum listing requirement of 40 and other specific conditions are eligible to a 3 cut off from the standard CIT rate. Below are applicable income tax rate for individual taxpayer.

Tax Identification Numbers In Laos Compliance By June 2021

For people earning over IDR 5 billion each year the HTL has established a new 35 income tax rate while a 5 tax rate will apply to annual net income of up to IDR 60 million up from the previous limit of IDR 50 billion.

. For resident taxpayer the top marginal income tax rate is 30 for income above IDR 500 million. In this respect the tax withheld by third parties referred to as Article 42 income tax constitutes the final settlement of the income tax for that particular income refer to pages. Corporate Tax Rate 2200.

More than IDR 500000000. Normal rate of taxation in Indonesia corporate income is 25. More than IDR 250 million up to IDR 500 million.

Sales Tax Rate 1000. The corporate income tax CIT rate in Indonesia is 25. Calculate your net salary after tax in Indonesia with our easy to use and up-to-date 2022 income tax calculator.

Tax System in Indonesia. Portion of income between Rp 50-250 million. For example if with an NPWP you would have faced a tax rate of 150 without an NPWP you would face a tax rate of 18.

Small business qualification. Income Tax Rates and Thresholds Annual. Rates Corporate income tax rate 22 Branch tax rate 22 plus 20 branch profits tax in certain circumstances Capital gains tax rate 22 standard ratevarious Residence.

PPh 26 Income Taxes If you are only staying temporarily in Indonesia and you receive an income in Indonesia you are also subject to. There are exceptions although the standard corporate income tax in Indonesia is 25 percent. The applicable final income tax rates are as follows.

In general a corporate income tax rate of 25 percent applies in Indonesia. 5 rows Taxable income IDR Tax rate Up to IDR 50 million. Your average tax rate ends up being around 0.

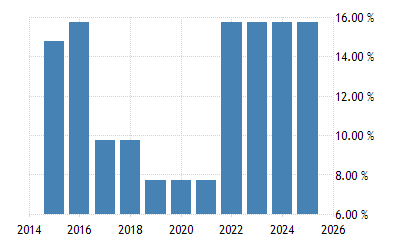

Personal Income Tax Rate in Indonesia averaged 3156 percent from 2004 until 2019 reaching an all time high of 35 percent in 2005 and a record low of 30 percent in 2009. Such a payment is referred to as Article 29 income tax. Calculate your net salary after tax in Indonesia with our easy to use and up-to-date 2022 income tax calculator.

Portion of income over Rp 500 million. Personal Income Tax Rate in Indonesia averaged 3156 percent from 2004 until 2019 reaching an all time high of 35 percent in 2005 and a record low of 30 percent in 2009. Note that this estimate is based only on the most common standard.

Building Permanent 20 years 5 Non-permanent 10 years 10 The comprehensive lists of the assets included in each category. More than IDR 500 million up to IDR 5 billion. You can find the details of the new.

Personal Income Tax Rate. Portion of income between Rp 250 million-500 million. A small business with a gross turnover of less than IDR 50 billion attracts only 50 off the standard tax rate.

Personal Income Tax Rate 3000. The tax is calculated by using the progressive rate five percent to 30 percent. Understanding Key Changes in Harmonized Tax Law HTL Personal Income Tax.

The Personal Income Tax Rate in Indonesia stands at 30 percent. Social Security Rate 774. Above IDR 50 million.

Taxable Annual Income. Effective fiscal year 2022 the lowest tax bracket cap for individual income tax will be increased from IDR 50 million to IDR 60 million and a new 35 tax bracket will be added for individuals earning more than IDR 5 billion annually. Portion of income between Rp 250 million-500 million.

This applicable tax rates are progressive based on annual income. Individuals with work competency certificate. While non-resident taxpayer individual shall be subject to income tax article 26 at 20 of the gross amount or non-taxable based on tax treaty Indonesia and other tax treaty partner using valid and complete DGT Form andor Certificate of Residence CoR.

Indonesia Residents Income Tax Tables in 2022. 6 Indonesian Pocket Tax Book 2021 PwC Indonesia Corporate Income Tax Tangible Assets Categories Useful Life Depreciation rate Straight line method Declining balance method Category 3 16 years 625 125 Category 4 20 years 5 10 II. Certain types of income earned by resident taxpayers or Indonesian PEs are subject to final income tax.

A flat CIT rate of 22 applies to net taxable income. 5 rows Taxable income in Indonesia. Indonesia Residents Income Tax Tables in 2020.

Companies that have a gross turnover below 50 Billion IDR have a discount on 50 from the standard corporate income tax in other words 125. Income Tax Rates and Thresholds Annual Tax Rate. Small business qualification.

Income earned by an individual who is working in Indonesia is subject to personal income tax. Indonesia Corporate Income Tax in Japanese. Personal Income Tax Rate Rp Rp 1-50 million.

More than IDR 5 billion. More than IDR 60 million up to IDR 250 million. Up to IDR 60 million previously IDR50 million 5.

Tax rates The corporate income tax rate which was expected to be reduced to 20 will remain at 22. A company is regarded as Indonesian tax resident if it is established or domiciled in Indonesia or if its place of effective management or control is in Indonesia. Companies that put a minimum of 40 of their shares to the public and are listed in the Indonesia Stock Exchange offer are taxed on 20.

Resident taxpayers must file personal income tax returns. Type of service Classification Rate GR-51 Classification Rate GR-9 Construction work. For fiscal year 20202021 the CIT rate is 22 and for the year 2022 onwards the CIT rate will be 20.

Why Indonesian Are Less Innovative The Role Of Tax Institution In Innovation Economics Accounting And Taxation Ecountax Com

Indonesia Income Tax Rates For 2022 Activpayroll

Laws Free Full Text Tax Policy In Action 2016 Tax Amnesty Experience Of The Republic Of Indonesia Html

Indonesia Salary Calculator 2022 23

Corporate Income Tax In Indonesia Acclime Indonesia

How To Calculate Foreigner S Income Tax In China China Admissions

Indonesia Payroll And Tax Guide

Flowchart Final Income Tax Download Scientific Diagram

Indonesia Social Security Rate 2021 Data 2022 Forecast 2007 2020 Historical

Top Marginal Income Tax Rates Selected Countries 1979 To 2002

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

Mengenal 5 Jenis Pajak Di Indonesia Beserta Contohnya Income Tax Filing Taxes Capital Gains Tax

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Corporate Income Tax In Indonesia Acclime Indonesia

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

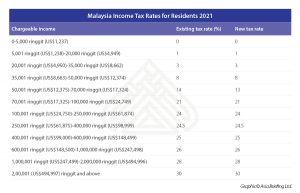

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday