michigan.gov property tax estimator

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The application of the property tax administration fee is.

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Please enable JavaScript to continue using this application.

. 2021 Millage Rates - A Complete List. Counties in Michigan collect an average of 162 of a propertys assesed fair. City Business and Fiduciary Taxes.

Michigan is a flat-tax state that levies a state income tax of 425. Tax Estimator Tax Estimator You can now calculate an estimate of your property taxes using the current tax rates. 2020 total property tax rates in michigan total millage industrial personal ipp cheshire twp 031030 allegan public school 331314 511314 271314 391314.

A total of 24 Michigan cities charge their own local income taxes on top of the state income tax. City Business and Fiduciary Taxes. Counties in Michigan collect an average of 162 of a propertys assesed fair.

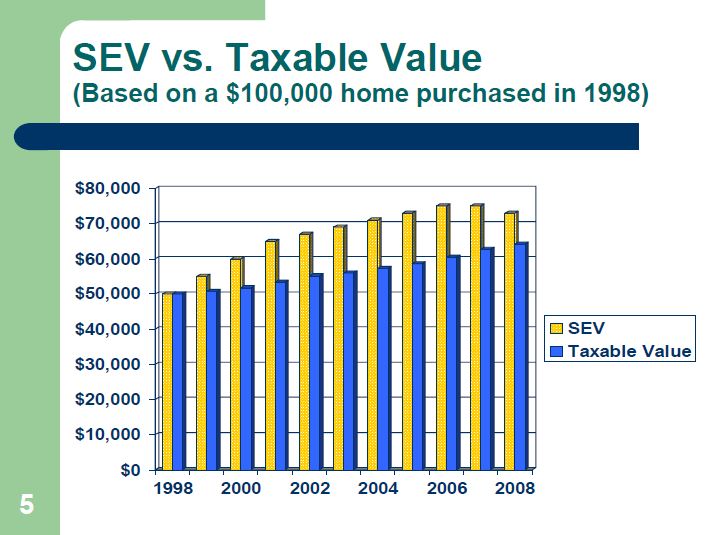

2020 Millage Rates - A Complete List. 41010 - Grand Rapids 41020 - Godwin 41050 - Caledonia 41110 - Forest Hills. In fact there are two different numbers that reflect your homes value on your Michigan real property.

The law allows for a property tax administration fee of not more than 1 of the total tax bill per parcel to apply to property taxes. Overview of Michigan Taxes. Follow this link for information regarding the collection of SET.

You should complete the Michigan Homestead Property Tax Credit Claim MI-1040CR to see if you qualify for the credit. Notice IIT Return Treatment of Unemployment Compensation. Michigan Taxes tax income tax business tax sales tax tax form 1040 w9 treasury withholding.

Michigans effective real property tax rate is 164. 2018 Millage Rates - A Complete List. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax.

Property Tax Estimator Property Tax Estimator You can now access estimates on property taxes by local unit and school district using 2020 millage rates. Enter the Taxable Value of your property and select the school district from. City Individual Income Tax.

2019 Millage Rates - A Complete List. The credit for most people is based on a comparison between property. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. For comparison the median home value in Michigan is. To avoid penalties for failure to make estimated tax payments your total tax paid through credits and withholding must be 70 percent of your current year tax or 70 percent of your prior year.

But rates vary from county to county. Office of the auditor general. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage.

Use this estimator tool to determine your summer winter and yearly tax rates and amounts. Office of the Auditor General. Michigans Wayne County which contains the city of Detroit has not only the highest property tax rates in the state but also some of the highest taxes of any county in the US.

Office of Inspector General. Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list.

A Michigan Man Underpaid His Property Taxes By 8 41 The County Seized His Property Sold It And Kept The Profits Reason Com Property Tax County Tax

Michigan Property Taxes What Is A Homestead Exemption

Why Property Taxes Go Up After Buying A Home In Michigan

Example Seller S Estimate Net In Texas Things To Sell Fort Hood Cost

Property Taxes How Much Are They In Different States Across The Us

Florida Property Tax H R Block

Why Property Taxes Go Up After Buying A Home In Michigan

States With The Highest And Lowest Property Taxes Property Tax States Tax

Redford Township Government Departments Assessor About The Assessing Office

Taxable Income Calculator India Income Business Finance Investing

Mshda Contact Mshda Property Improvements Physical Wellness Low Income Housing

Property Tax How To Calculate Local Considerations

Deducting Property Taxes H R Block

Markham Property Tax 2021 Calculator Rates Wowa Ca

Michigan Property Tax H R Block

Tax Bill Information Macomb Mi

Should You Be Charging Sales Tax On Your Online Store Retirement Income Income Tax Tax Free States